Unlock Financial Growth: How Debt Recycling Can Boost Your Investment Strategy

admin October 14, 2025 Unlock Financial Growth: How Debt Recycling Can Boost Your Investment Strategy Make your money work smarter...

admin

September 12, 2024

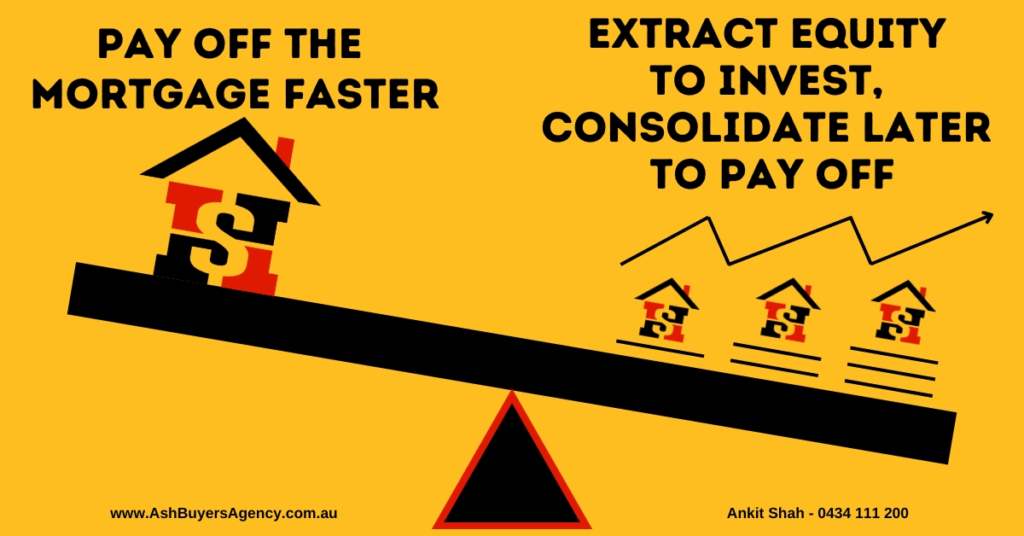

Deciding whether to pay off your mortgage faster or invest is a common dilemma.

Paying down your mortgage (or utilizing an offset or redraw facility) gives you a return that equals your mortgage interest rate, and it comes with no risk of losing capital. This is especially true if it’s with an ADI and falls under the $250,000 government guarantee.

On the other hand, investing in shares generally offers a higher expected return compared to the mortgage interest rate. Historically, stocks have provided returns of around 10%, but this isn’t guaranteed. A higher expected return also brings higher risk, leading to a broader range of potential outcomes. Your actual return could vary significantly from what’s expected.

Some people highlight that the return from paying down your mortgage (or using an offset or redraw) is tax-free because it comes from reducing expenses rather than receiving income. So, it should be grossed up when compared to investing. However, with debt recycling, investing can share this tax-free benefit and even offer more advantages.

The decision between paying off the mortgage faster or investing is quite similar to borrowing to invest. This strategy can be a good fit if you have:

With regards to paying down excess funds into your mortgage vs investing:

The last two items are what needs focusing on – a long time horizon and a high risk tolerance. Both of these relate to the fact that investing to achieve a higher return than the interest cost means investing in growth assets. Since growth assets are volatile by nature, you need a long enough time horizon and a high enough tolerance to see your investment’s value fall significantly in the short and medium-term without selling.

Ultimately, the decision to pay off your mortgage faster versus investing hinges on your risk tolerance.

You have a higher risk tolerance when you:

A higher risk tolerance enables you to invest more aggressively, offering the potential for a higher expected return. This return is more likely to materialize the longer you leave your investment untouched.

Conversely, if you’re uncomfortable with debt (as many people are), worried about job security, especially with dependents, or concerned about being tied to your job to pay down debt, it’s perfectly reasonable to prioritize paying extra on your mortgage. While the long-term expected return from investing might be higher, the actual return of paying down the loan is certain.

In summary, your risk tolerance will dictate whether to allocate your additional capital towards safe or risky investments (like your mortgage).

Safe investments are ideal when you have:

Risky investments are better suited when you have:

Whatever your choice, avoid rotating back and forth based on fluctuating interest rates on your home loan. Rotating back and forth is the quickest way to erode your returns. Instead, pick a strategy and stick to your plan.

And remember, you don’t have to choose between the two. You can hedge your bets by investing part of your capital in shares and putting the rest into an offset account to reduce your mortgage. It’s not necessarily an either/or decision.

If you do decide to invest:

Superannuation is specifically designed to help build your retirement savings. It’s not an investment itself but serves as an investment vehicle—a legal structure that holds various investments like stocks, bonds, property, and cash, much like investments outside of super. What sets super apart are the massive tax concessions it offers, which are designed to boost your savings for retirement. However, these funds remain inaccessible until you meet a condition of release, typically reaching retirement age.

There’s a strong case for contributing to super over paying down your home loan, especially if you’re on a high marginal tax rate. By contributing concessionally up to the $27.5k threshold each year, those on a 47% MTR can receive an instant return of 60% on every dollar contributed—a significant advantage, even if it means locking away the funds for 30 years. For those on a 32% MTR, the instant return is still a compelling 25%. Additionally, there are ongoing tax savings on dividends and a compounding effect on the extra funds.

For an early retiree, it’s crucial to consider the lack of access to these funds and the potential changing laws regarding when you can access super.

For more information, explore the following articles:

While the savings used to pay down your home loan remain tax-free and earnings from investments are taxable, you can reduce tax on your investment earnings through debt recycling.

This strategy effectively neutralizes the advantage of paying down your mortgage over investing.

Debt recycling allows you to convert debt from non-deductible to tax-deductible debt.

For example, if you had a $100,000 loan on your home with a 4% interest rate, you’d pay $4,000 in interest annually. By converting this into tax-deductible debt, you could reduce your taxable income by that $4,000. With a 30% marginal tax rate, you’d save $1,200 in taxes each year. Essentially, the government effectively pays 1.2% of that 4% interest, leaving you with a 2.8% interest rate.

Whether interest is tax-deductible depends on how the borrowed money is used, not the source of the loan.

A loan on your PPOR (principal place of residence) is considered non-deductible debt since a PPOR is not an investment. However, if you have funds to invest, you can pay down your PPOR loan, reborrow that amount, and invest it in income-producing assets. By doing so, you’ve recycled your non-deductible debt into tax-deductible debt, allowing you to benefit from tax-deductible interest as long as the loan remains invested in income-producing assets. Debt recycling is one of the most effective tax-minimisation strategies for those with a home loan, outside of super.

Beyond reducing tax, debt recycling helps you build an investment portfolio outside of super that generates passive income, supplements your superannuation, and provides accessible income before super becomes available.

This article on debt recycling covers the following:

1. As Table 1 from the RBA report on the Australian Equity Market over the Past Century indicates, returns have averaged 10.2%.

2. When considering your main residence loan or using an offset/redraw facility, it’s important to *gross up* the interest rate to reflect a pre-tax return equivalent. Given a 4% interest rate and a 32% marginal tax rate (including the 2% Medicare levy), the calculation is as follows:

4% x 1/(1 – 32%) = 5.9%. Debt recycling offers the same advantage in this context.

3. Investing can provide a higher return than simply holding cash, due to several factors:

admin October 14, 2025 Unlock Financial Growth: How Debt Recycling Can Boost Your Investment Strategy Make your money work smarter...

admin September 30, 2025 What Every Investor Must Know: 12 Key Points for Smart Investing Property investing can be one...

admin September 26, 2025 From 1 October 2025: No cap on places and higher property price limits for first home...

Buying your first home or interstate investment might seem hard, but with Ash Buyers Agency, we make it easier. We help, educate and execute making the process simple and rewarding for our clients.

© 2025 · Ash Buyers Agency. All rights reserved. It is illegal to reproduce or distribute copyrighted material without the permission of the copyright owner.