admin

March 13, 2024

Why today’s stamp duty bills are higher than those of earlier generations?

Why today’s stamp duty bills are higher than those of earlier generations?

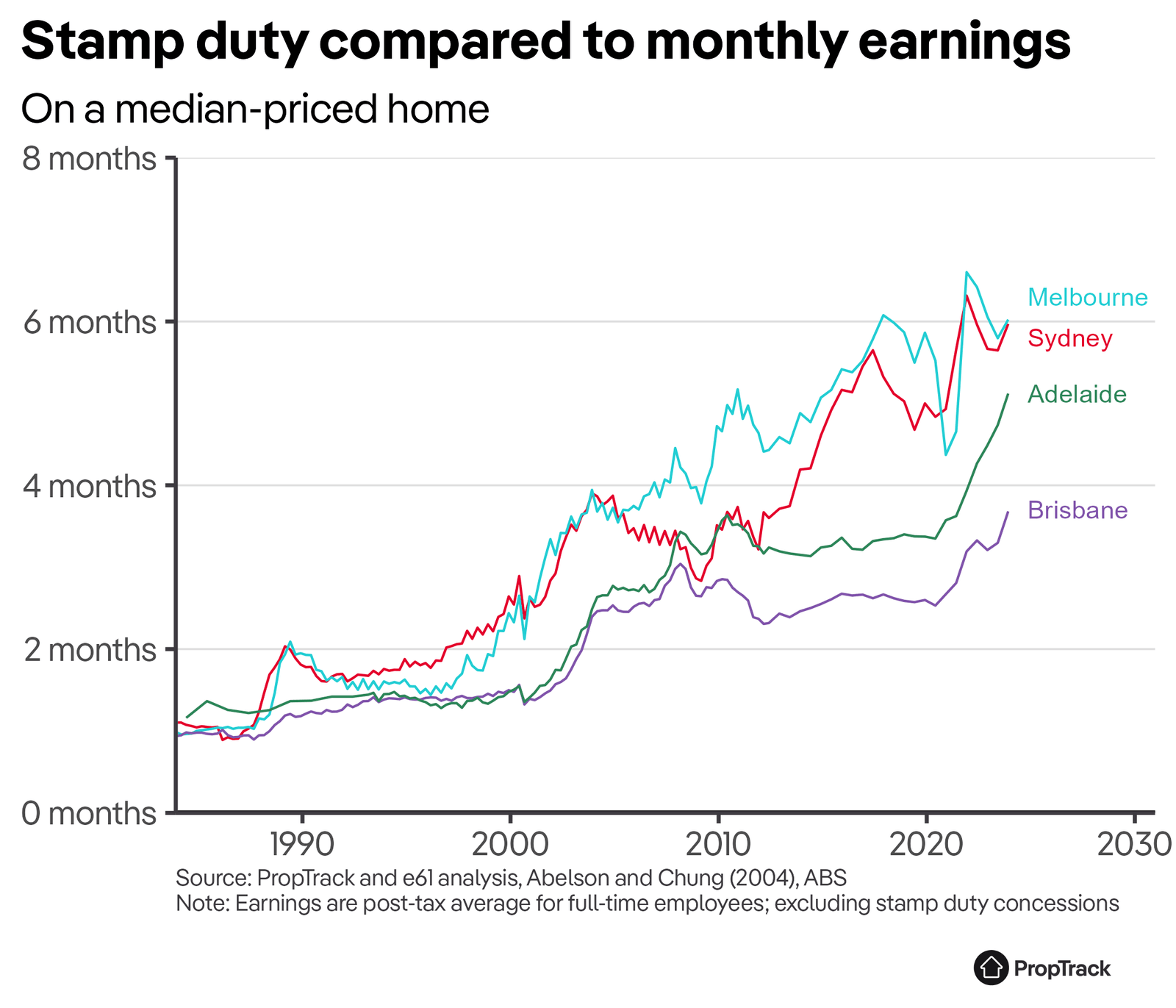

Stamp duty, the tax you pay when buying a house, has become a big problem in just one generation. New research shows it’s now five times more expensive than before, even when you adjust for inflation. This tax eats up a huge chunk of people’s income, making it harder for them to move house, change jobs, or start a family.

In places like Melbourne and Sydney, where house prices have shot up, stamp duty costs have skyrocketed too. In Melbourne, you’d need to save up six months’ worth of your income just to cover the stamp duty on an average-priced home. Sydney’s not much better, with stamp duty eating up half a year’s pay.

This tax isn’t just a pain in the wallet; it’s causing people to put off important life decisions. Many young Australians are delaying changing jobs or having kids because of the high cost of stamp duty. This isn’t just bad for individuals—it’s slowing down the whole economy.

One big reason stamp duty is so high is because of something called bracket creep. Basically, as house prices go up, more and more people get pushed into higher tax brackets. This means they end up paying more in stamp duty.

Despite all the evidence showing how bad stamp duty is, governments have been slow to do anything about it. But now, with most governments being from the same political party, there’s a chance they might finally work together to fix this problem.

In short, stamp duty is a huge obstacle for many Australians. It’s time for governments to step up and find a fairer way to tax property purchases.

Buying your first home or interstate investment might seem hard, but with Ash Buyers Agency, we make it easier. We help, educate and execute making the process simple and rewarding for our clients.

Join Our Newsletter

© 2026 · Ash Buyers Agency. All rights reserved. It is illegal to reproduce or distribute copyrighted material without the permission of the copyright owner.