What Every Investor Must Know: 12 Key Points for Smart Investing

admin September 30, 2025 What Every Investor Must Know: 12 Key Points for Smart Investing Property investing can be one...

admin

November 15, 2024

Our property markets continue to rise in value, though at a steadier pace than earlier this year.

CoreLogic estimates that the combined value of residential real estate has reached a trillion-dollar market, hitting $11 trillion by the end of September. I remember the excitement when it previously hit $9 trillion before the pandemic.

Last week, 2,820 auctions were held—the second-highest volume recorded in the spring season so far, and the fifth-highest volume of auctions for 2024. The preliminary auction clearance rate reached 65.8% across the combined capitals.

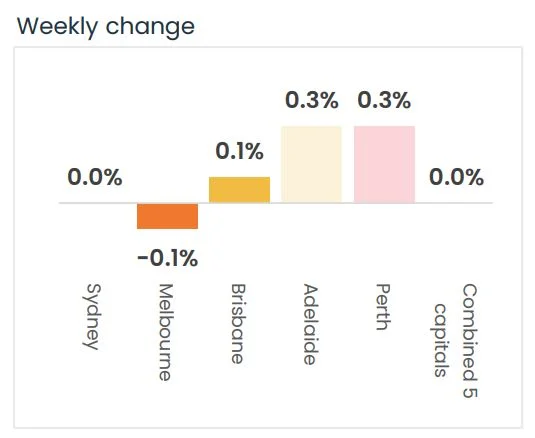

CoreLogic Research reports this week show varied market trends across cities:

In aggregate, Australian capital dwelling prices have increased by 0.2% over the last month and stand 6% higher than a year ago. Looking ahead, property prices and rents are expected to continue on an upward trajectory throughout 2024.

This property cycle is currently driven by an undersupply of good properties relative to current demand, fueling both increasing property values and rental increases. Experts agree that the persisting undersupply won’t be resolved soon, as the housing construction targets necessary to meet demand remain out of reach. For now, exciting growth and positive capital growth signal a strong market with promising prospects.

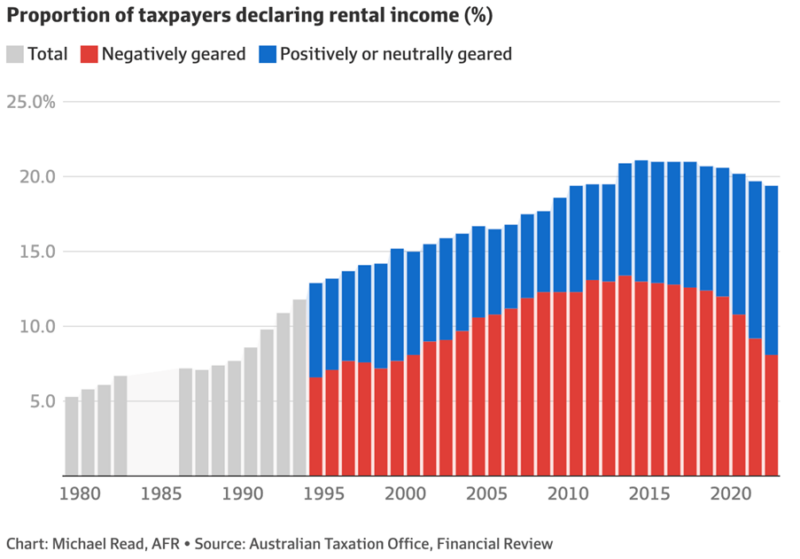

The number of private property investors in Australia is dwindling, with recent figures revealing a significant drop. This decline is expected to worsen the rental shortage, driving up rents even further.

Factors like rising interest rates, regulatory pressures, increased taxes, and high compliance costs are prompting many investors to sell or halt new investments. Victoria has been especially impacted due to higher land taxes and stricter tenancy regulations.

For decades, private investors have supplied over 90% of Australia’s rental housing, but their diminishing presence now poses a real threat to an already strained market. The number of property investors fell to 2.29 million in 2021-22 from a peak of 2.39 million in 2019-20. With fewer private investors, rental properties are now in short supply, vacancy rates have plummeted to below 1% in some areas, and rents are on the rise.

To bring investors back into the market, I believe we need stability in policy, along with reduced regulatory and tax burdens and new incentives for rental property investment. These changes would help restore investor confidence and relieve pressure on the rental supply.

Without meaningful policy shifts that support private investors, Australia’s rental crisis will only deepen. Encouraging private investment is essential for building a resilient, balanced rental market capable of providing long-term, affordable housing for all Australians.

On the auction front, a high volume of 2,820 auctions were held last week, marking the second-highest count of the spring season and the fifth-highest for 2024 to date. The preliminary auction clearance rate reached 65.8% across the combined capitals, as noted in the latest CoreLogic report.

CoreLogic also highlights seasonal trends in property prices this week:

Overall, Australian capital dwelling prices increased by 0.2% over the past month, standing 6% higher than a year ago. The property cycle is driving market movement, but fragmented markets across the capital continue to show distinct patterns of capital growth and dwelling price shifts.

These are overall figures, as there isn’t just one single Sydney, Melbourne, or Brisbane property market. Various segments within each capital city are performing differently, with distinct trends across different market segments. At the start of this cycle, the upper quartile helped lead the upswing; however, the lower quartile has now recorded a stronger outcome in housing values compared to its upper quartile counterpart over the past quarter. The chart analysis below highlights how various segments of each capital city market are performing differently, with median-priced properties showing solid market performance.

Property asking prices are a useful leading indicator for housing markets – giving a good indication of what’s ahead.

Here is the latest data available:

| Property type | Price ($) | Weekly Change | Monthly Change % | Annual % change |

| All Houses | 1,949,999 | 12.901 | 1.4% | 4.5% |

| All Units | 835,684 | -5.284 | -0.3% | 7.1% |

| Combined | 1,498,411 | 5.148 | 1.0% | 4.7% |

| Property type | Price ($) | Weekly Change | Monthly Change % | Annual % change |

| All Houses | 1,249,865 | -0.465 | 0.4% | 3.3% |

| All Units | 612,873 | -1.585 | 0.1% | 3.0% |

| Combined | 1,049,674 | -0.991 | 0.3% | 3.0% |

Property type | Price ($) | Weekly Change | Monthly Change % | Annual % change |

All Houses | 1,182,356 | -1.084 | 0.2% | 16.8% |

All Units | 668,027 | 1.423 | 0.8% | 23.2% |

Combined | 1,053,738 | -0.544 | 0.2% | 17.6% |

Property type | Price ($) | Weekly Change | Monthly Change % | Annual % change |

All Houses | 1,086,352 | 9.997 | 1.5% | 25.4% |

All Units | 579,731 | 2.199 | 2.4% | 27.2% |

Combined | 954,039 | 7.875 | 1.6% | 25.6% |

Property type | Price ($) | Weekly Change | Monthly Change % | Annual % change |

All Houses | 946,363 | -3.163 | -0.9% | 15.9% |

All Units | 473,203 | 1.092 | 1.8% | 8.0% |

Combined | 861,376 | -2.417 | -0.6% | 15.1% |

Property type | Price ($) | Weekly Change | Monthly Change % | Annual % change |

All Houses | 1,178,362 | -1.500 | 1.0% | 3.4% |

All Units | 599,488 | 0.637 | 0.5% | 0.2% |

Combined | 965,524 | -1.150 | -0.8% | 2.2% |

Property type | Price ($) | Weekly Change | Monthly Change % | Annual % change |

All Houses | 687,272 | 1.758 | 2.6% | -0.3% |

All Units | 383,138 | -1.472 | -0.4% | 1.6% |

Combined | 567,906 | 0.502 | 1.8% | 0.1% |

Property type | Price ($) | Weekly Change | Monthly Change % | Annual % change |

All Houses | 805,052 | 5.857 | 1.0% | 1.6% |

All Units | 476,314 | 0.504 | -1.8% | -9.3% |

Combined | 755,277 | 4.999 | 0.8% | 0.4% |

Property type | Price ($) | Weekly Change | Monthly Change % | Annual % change |

All Houses | 952,602 | 7.664 | 0.9% | 8.3% |

All Units | 562,507 | -2.266 | -0.5% | 8.3% |

Combined | 868,678 | 5.364 | 0.7% | 8.2% |

Property type | Price ($) | Weekly Change | Monthly Change % | Annual % change |

All Houses | 1,413,652 | 9.837 | 1.3% | 8.2% |

All Units | 703,503 | -4.505 | -1.0% | 8.0% |

Combined | 1,203,467 | 5.372 | 0.9% | 7.9% |

The value of property asking prices as a leading indicator in housing markets is quite significant.

Unlike median prices, which can sometimes misrepresent actual trends, asking prices offer a closer look into market sentiment, acting as a real-time indicator of seller expectations.

While asking prices offer valuable early indications and insights, they are most effective when considered with other market dynamics, including actual sales prices, time on the market, auction clearance rates, and prevailing economic conditions.

With 2,820 auctions held last week, it marked the second-highest volume so far in the spring season and the fifth-highest volume of auctions throughout 2024.

The preliminary auction clearance rate reached 65.8% across the combined capitals, which is 2.4 percentage points higher than the previous week yet slightly below the average for spring to date (67.1%).

Melbourne hosted the highest volume of auctions last week, with 1,293 homes going to market, marking the third-highest weekly volume of auctions so far this spring season.

Based on the preliminary collection, 66.5% of auctions achieved a successful result, up from 62.4% the previous week and closely aligning with the spring season average of 66.4%.

Sydney followed with 1,073 auctions held, recording the third-highest volume so far this year and the second-highest for the spring season to date.

The preliminary figures show a positive result for 68.2% of Sydney’s auctions, an increase from 65.5% the prior week and slightly below the spring season average of 68.4%.

Sydney’s auction clearance rate has remained below 70% for six of the past seven weeks.

In the smaller capitals, Brisbane saw the most auctions, with 175 homes going under the hammer, though this marked the lowest weekly volume in five weeks.

So far, 53.2% of Brisbane auctions have been reported as successful, an improvement from 52.3% the week before, but still below the spring-to-date average of 57.4%.

Adelaide recorded 160 auctions, with a strong performance of 70.1% selling.

In the ACT, 94 auctions were held with a preliminary clearance rate of 45.2%, the lowest reported since the early pandemic phase in April 2020.

Perth saw 22 auctions, with 53.8% selling, while Tasmania had just three auctions.

This week, we’re expecting to see over 2,900 auctions held, before scaling back slightly to around 2,550 the following week.

National rents saw a subtle bounce back in October, rising by 0.2%, which marks a recovery from the weaker growth observed over the previous three months. However, this increase is less than a third of the 0.7% monthly rise seen in October over the past three years.

Annual rental growth has dropped to 5.8%, marking the smallest rise in the rental index since the 12 months ending April 2021.

As rents are a significant component of the CPI calculation, the slowdown in rental growth serves as a positive signal for inflation. CPI-rent data has dropped to 6.7% in Q3 2024, down from a high of 7.8% in Q1.

The easing in demand aligns with a slowdown in net overseas migration and a rise in average household sizes, as the effects of the pandemic shrink trend begin to wear off.

Property type | Price ($) | Weekly Change | Monthly Change % | Annual % change |

All Houses | $1,047.65 | 7.35 | 0.7% | 3.8% |

All Units | $692.27 | 0.73 | -0.6% | 2.6% |

Combined | $836.45 | 3.38 | 0.1% | 3.2% |

Property type | Price ($) | Weekly Change | Monthly Change % | Annual % change |

All Houses | $743.41 | 3.59 | -0.3% | 5.6% |

All Units | $544.49 | -0.49 | -1.0% | 4.2% |

Combined | $626.75 | 1.23 | -0.6% | 5.0% |

Property type | Price ($) | Weekly Change | Monthly Change % | Annual % change |

All Houses | $724.62 | -0.62 | -1.0% | 1.9% |

All Units | $577.73 | -1.73 | 0.0% | 5.6% |

Combined | $658.50 | -1.13 | -0.6% | 3.3% |

Property type | Price ($) | Weekly Change | Monthly Change % | Annual % change |

All Houses | $788.86 | 2.14 | -1.0% | 7.0% |

All Units | $618.70 | -0.70 | 0.2% | 13.6% |

Combined | $716.31 | 1.00 | -0.5% | 9.4% |

Property type | Price ($) | Weekly Change | Monthly Change % | Annual % change |

All Houses | $659.06 | -0.06 | 0.0% | 9.4% |

All Units | $501.70 | 2.30 | -1.9% | 15.1% |

Combined | $605.29 | 0.80 | -0.5% | 11.1% |

Property type | Price ($) | Weekly Change | Monthly Change % | Annual % change |

All Houses | $763.63 | 5.37 | 2.9% | 5.6% |

All Units | $557.96 | 2.04 | 0.3% | -1.0% |

Combined | $651.59 | 3.46 | 1.7% | 2.3% |

Property type | Price ($) | Weekly Change | Monthly Change % | Annual % change |

All Houses | $720.34 | 7.66 | -4.7% | -2.5% |

All Units | $519.53 | 7.47 | 9.9% | 13.1% |

Combined | $601.01 | 7.55 | 2.3% | 5.0% |

Property type | Price ($) | Weekly Change | Monthly Change % | Annual % change |

All Houses | $537.11 | -1.11 | 0.1% | 2.7% |

All Units | $453.03 | -8.03 | 0.4% | -0.3% |

Combined | $503.40 | -3.87 | 0.2% | 1.6% |

Property type | Price ($) | Weekly Change | Monthly Change % | Annual % change |

All Houses | $701.00 | 0.00 | -0.6% | 5.4% |

All Units | $548.00 | -1.00 | 0.0% | 7.5% |

Combined | $629.96 | -0.46 | -0.3% | 6.3% |

Property type | Price ($) | Weekly Change | Monthly Change % | Annual % change |

All Houses | $839.00 | 9.00 | 0.2% | 5.1% |

All Units | $619.00 | 2.00 | -0.5% | 4.6% |

Combined | $721.87 | 5.27 | -0.1% | 4.9% |

New listings levels have remained above average, with 39,994 new listings observed nationally over the four weeks to September 1st.

While winter is historically a seasonally slow period for listings, the listing activity during the final month of winter was 4% above last year and 16.7% higher than the historic five-year average.

The challenge, however, is that very few of these listings are Grade homes or investment-grade properties. Owners of quality properties are still holding onto their assets.

At the national level, 155,875 total listings were observed over the four weeks to November 3rd, 2024.

The spring selling season has continued to ramp up, with 45,155 newly advertised listings counted over the four weeks to November 3rd. This represents a 1.3% higher flow of new listings compared to last year and is 0.8% above the historic five-year average, reflecting the latest market trends and offering opportunities for strategic timing.

At a national level, properties are taking slightly longer to sell compared to the property boom of 2020 and 2021. However, the time taken to sell is still relatively low, indicating a tight supply situation for quality properties, and vendor discounting remains at low levels.

In general, houses are selling faster than apartments, but the scarcity of good properties on the market is causing A-grade properties to sell quickly with minimal discounting.

Are you wondering what the right thing to do is in this interesting phase of the property cycle?

If you’re like many property investors, you may be wondering whether you should buy, sell, or simply wait.

You can trust the team at Ash Buyers Agency to provide you with direction, guidance, and results.

Whether you’re a beginner or an experienced investor, during times like we are currently experiencing, you need an advisor who takes a holistic approach to your wealth creation—and that’s exactly what you’ll receive from the multi-award-winning team at Ash Buyers Agency.

We help our clients grow, protect, and pass on their wealth through a range of services including:

Strategic property advice – Allow us to build a Strategic Property Plan for you and your family. Planning is bringing the future into the present so you can do something about it now! Click here to learn more Buyer’s agency in Sydney – As Australia’s most trusted buyers’ agents we’ve been involved in over $ 4 billion worth of transactions creating wealth for our clients and we can do the same for you. Our on-the-ground teams in Melbourne, Sydney, and Brisbane bring you years of experience and perspective – that’s something money just can’t buy. We’ll help you find your next home or an investment-grade property.

For more information or to discuss your property investment needs, get in touch with Ash Buyers Agency today. Our team of experts is ready to help you find the best opportunities. Call us at +61 434 111 200 or email us at info@AshBuyersAgency.com.au to start your journey toward making smarter property investments.

admin September 30, 2025 What Every Investor Must Know: 12 Key Points for Smart Investing Property investing can be one...

admin September 26, 2025 From 1 October 2025: No cap on places and higher property price limits for first home...

admin September 22, 2025 7 things you should know before starting a real estate investment Real estate investment can be...

Buying your first home or interstate investment might seem hard, but with Ash Buyers Agency, we make it easier. We help, educate and execute making the process simple and rewarding for our clients.

© 2025 · Ash Buyers Agency. All rights reserved. It is illegal to reproduce or distribute copyrighted material without the permission of the copyright owner.